**** This version is specifically design for CHINESE stock market ONLY

**** Should you want to build your US portfolio, Please consider the

**** Alpha-Investor (VG) or Alpha-Investor (US) app instead

"Earn the returns your portfolios have been missing.”

If you think investment is easy, think again. Investing without risk management is like driving a Porsche without a braking system. A lot of people learn their lessons without a warning. See if you can answer the following questions:

“Does my investment diversified enough and properly?”

“Do I know when to sell and when to buy in rapid moving market?”

“Do I sell the losing stocks without holding them for too long?”

“Is the worst monthly expected loss of my portfolio within my risk tolerance?”

“First thing first, does it make sense to invest with the current portfolio?”

If not, Alpha-Investor is what you need. Alpha-Investor is first mobile MYOP (Manage Your Own Portfolio) app. It is a full-feature trading suit designed for serious investors and investment professionals.

Feature List :

•Asset Search : rank/select top assets

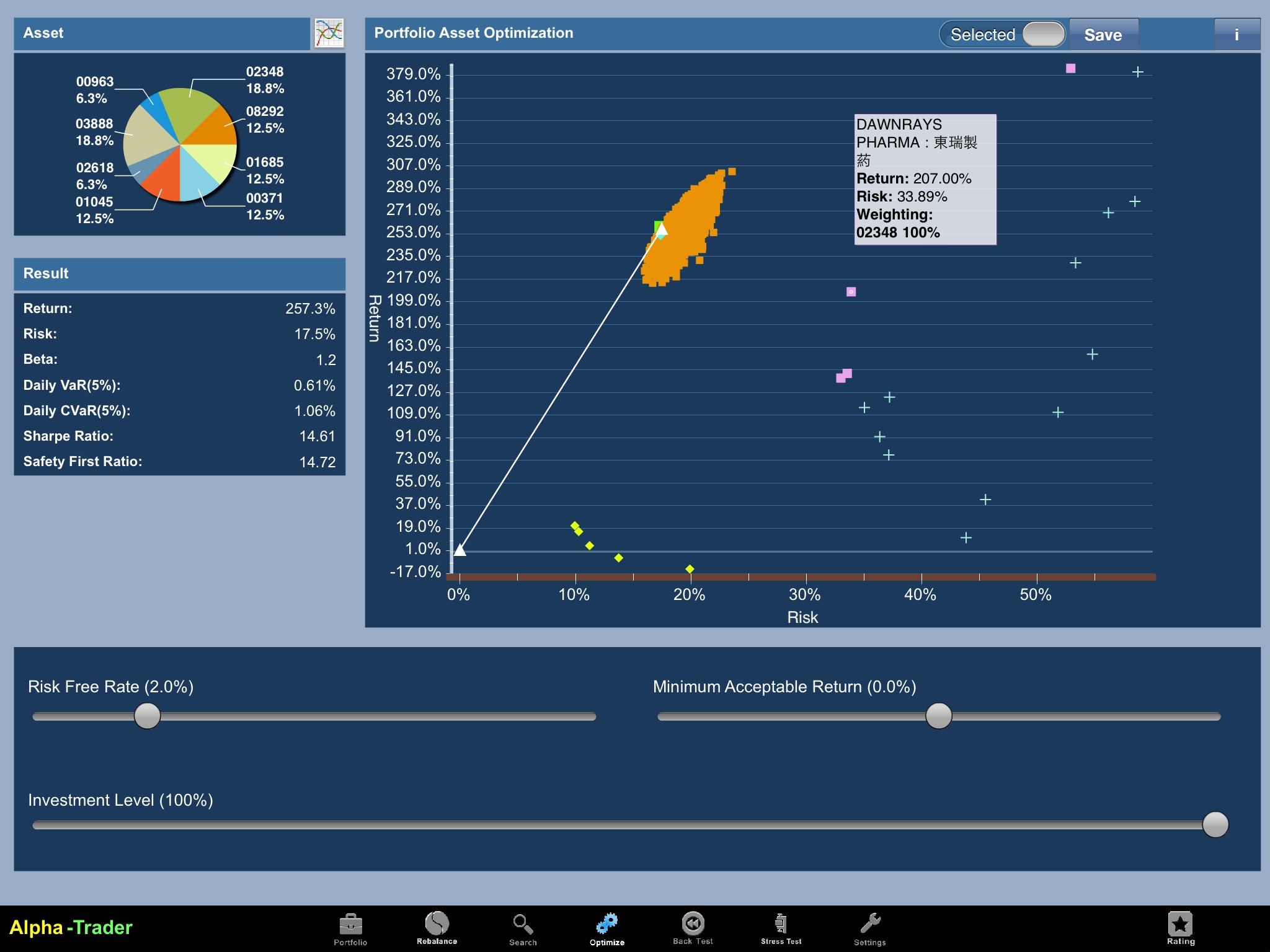

•Portfolio Optimizer : Optimize portfolio

•Back-Tester : validate portfolio with historical data

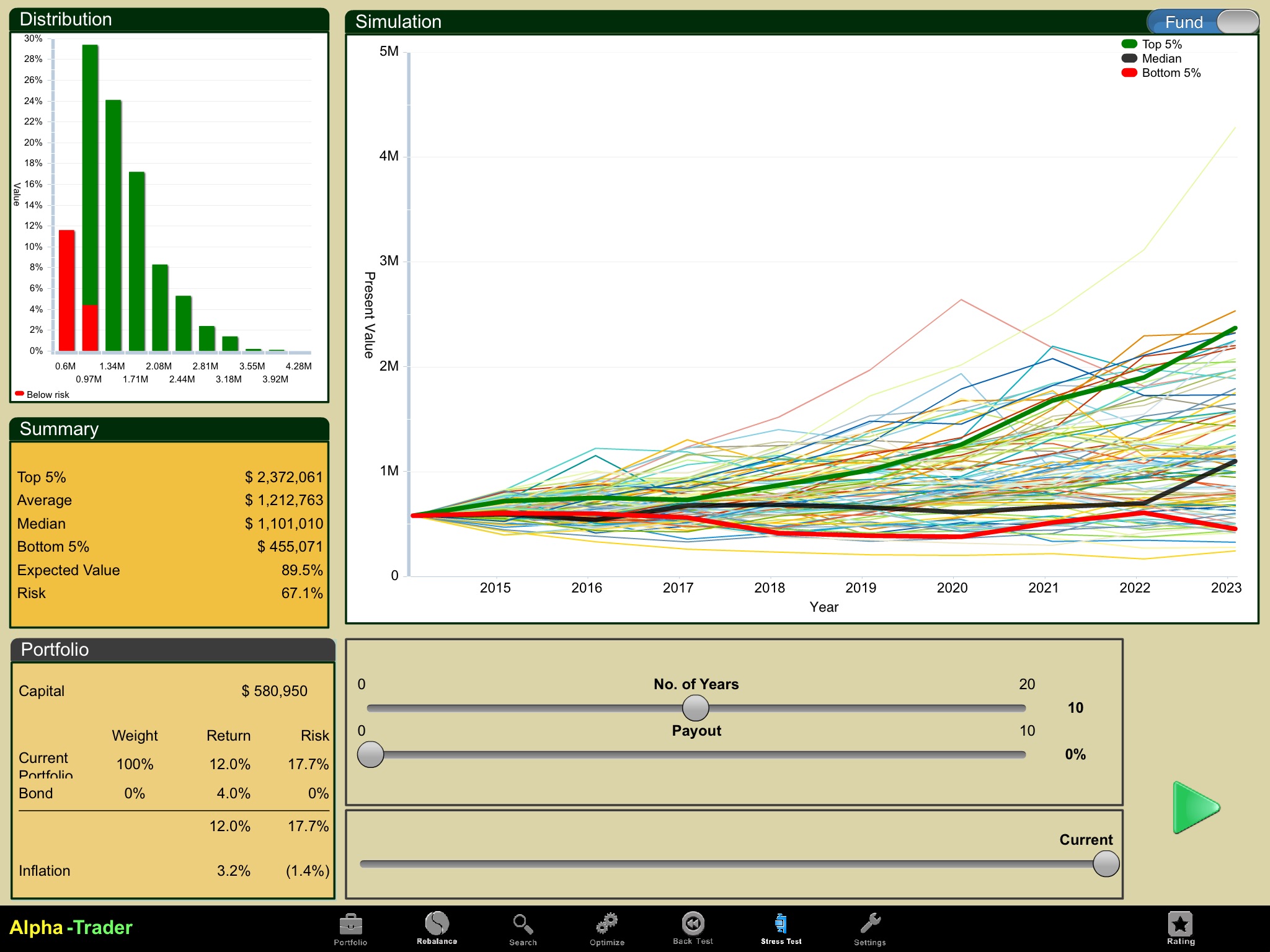

•Monte Carlo Simulator : multi-year forecast

•Re-Balancer : control risk exposure

Why Strategic Asset Allocation?

1. Research reveals that 90% of return from asset allocation.

2. Behavioral finance reveals that investors, including professionals, make all kind of mistakes.

What does Alpha-Investor do?

1. Optimize your asset weighting of your investment portfolio.

2. Validate your optimized portfolio by back-testing with historical data.

3. Limit your risk exposure within your risk tolerance.

4. Issue Buy/Sell signals with trading amount.

5. Determine if the portfolio worth the effort by calculating its Alpha value.

How does Alpha-Investor do it?

1. The “Optimizer” gives the optimal asset weighting by mean of mean-variance calculation.

2. The “Backtester” validates the portfolio performance with historical data.

3. The risk KPI’s, such as Value at Risk and Tail VaR, show you the daily risk exposure.

4. Based on target weighting, the “Rebalancer” gives Buy/Sell orders promptly.

5. Knowing the portfolio Alpha, investors can determine if passive investment is a better choice.

What is the typical profile of Alpha-Investor users:

•Investment Philosophy: Strategic Asset Allocation.

•Perquisites: Sound knowledge of Portfolio Management.

•Investment horizon: short-term/mid-term.

This multi-market version allows investors manage different country portfolios with various investment horizons in a single portfolio management app on iPad.

With Alpha-Investor you have a better chance to beat the street by beating your worst enemy first– Yourself.

*** Release Note ***:

Version: CN market

Capacity: 10 portfolios with 20 assets

Backup/Restore portfolios to cloud server

User License : Dec 31, 2015

Email support: Dec 31, 2015